Enverus Intelligence Research in their latest FundamentalEdge report has confirmed that the Biden administration’s ongoing major drawdown of the U.S. Strategic Petroleum Reserve (SPR) has had little influence on the oil market.

Crude Price-Reduction Initiatives Futile

According to the report, despite initiatives to relax oil markets, oil prices remain tight nearly three months into the Ukraine conflict. Bill Farren-Price, the principal study author and head of Enverus Intelligence Research, warns that oil markets may become unstable again later this year. He said, “We see a tangible risk that oil markets will become volatile again later this year and into 2023 when the stock releases end. The release of oil from the Strategic Petroleum Reserve buys time for producers in the U.S. to push harder and for Iran nuclear diplomacy to bear fruit”.

Rising Crude Prices

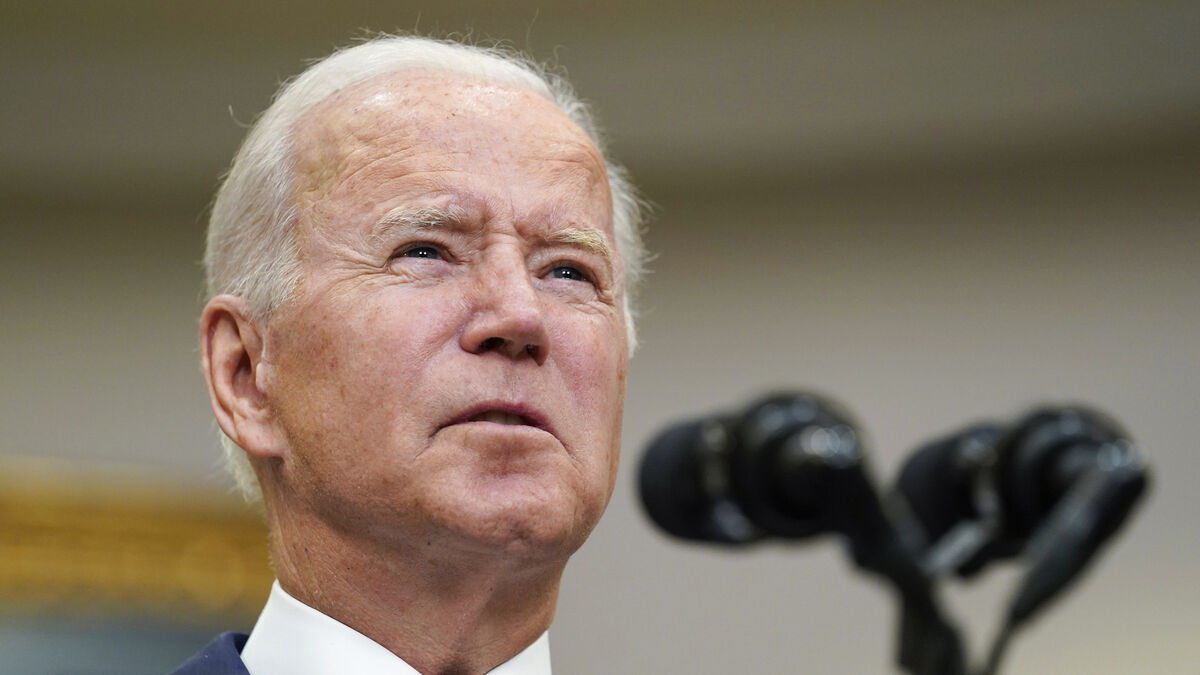

Following a price increase in crude, President Joe Biden authorized a substantial fresh reduction of the U.S. SPR on March 10 after Brent Crude briefly topped $129 before settling at $127.98 per barrel. Crude prices have risen again as of May 31, with Brent Crude trading at $123 per barrel and West Texas Intermediate trading at over $119.

Source: Forbes

Aw, this was a very nice post. In thought I would like to put in writing like this moreover – taking time and actual effort to make a very good article… but what can I say… I procrastinate alot and in no way seem to get one thing done.

Heya i am for the first time here. I found this board and I find It truly useful & it helped me out much. I hope to give something back and help others like you helped me.

I enjoy the efforts you have put in this, regards for all the great content.

Good write-up, I¦m normal visitor of one¦s web site, maintain up the nice operate, and It’s going to be a regular visitor for a long time.