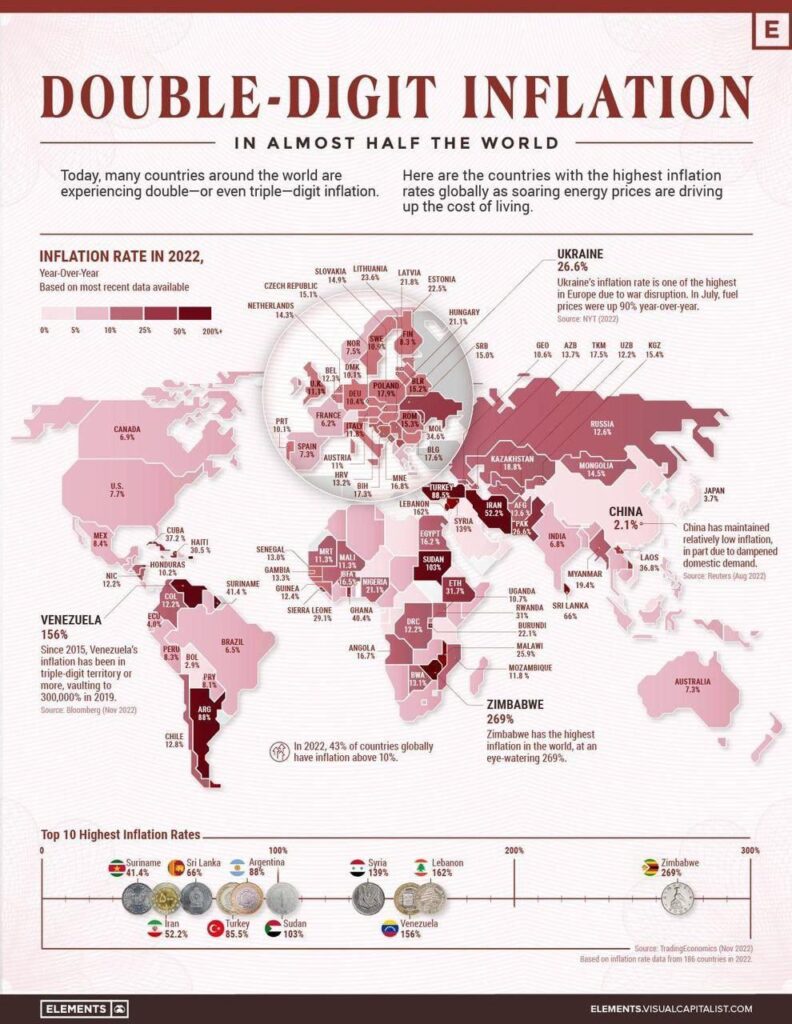

Inflation on a global scale is predicted to reach 8.8% in 2022. But some nations are being affected considerably more severely than others.

Worldwide, inflation rates are skyrocketing. Prices are rising by double or triple digits in many economies.

In the context of economics, inflation refers to the rate of growth in a nation’s average prices for goods and services. An unstable indicator, inflation can change quickly depending on the state of the economy and the policies a government decides to enact to manage or combat it.

Depending on the situation and the pace of change, inflation can be perceived positively or adversely and is related to the economic concepts of supply and demand.

Types of Inflation Indexes

The consumer price index (CPI), the wholesale price index (WPI), and the producer price index (PPI) are the three inflation indices. The CPI is a metric that looks at the consumer/retail level weighted average prices for basic requirements like transportation, food, and healthcare. Before the items reach the consumer, the WPI gauges and monitors price fluctuations at the producer or wholesale level. The PPI is a group of indicators that gauges price changes from the viewpoints of producers and sellers rather than consumers and buyers.

What Causes Inflation?

Demand-pull inflation, cost-push inflation, and built-in inflation are the three categories under which inflation is categorized. All three of these have to do with a nation’s economy’s ability to maintain a balance between the supply of products and the supply of money.

- Demand-pull inflation – This occurs when demand for goods and services—or, to put it another way, the total quantity of money or credit that people have available for spending—increases more quickly than the economy’s capacity for production. Prices increase because supply can’t keep up with the increasing demand. A fall in demand and a restoration of the supply-demand balance usually result from some purchasers leaving the market as a result of the rising prices.

- Cost-push inflation – This occurs as a result of the rise in production costs. For instance, if the cost of the raw materials used to make a product rises, producers will pass those costs on to consumers, increasing the price of the finished product.

- Built-in inflation – Finally, this occurs as a result of the belief that inflation will remain high; hence, salaries must increase to keep things as they are. Labour expects to be paid more as the cost of products and services rises in order to maintain their standard of living. Consumer prices for the commodities or services that labour creates or delivers rise together with the cost of labour.

Inflation: A Result of Global Forces

The invasion of Ukraine by Russia directly affected the level of prices around the world. Since Russia is a major exporter of oil and gas and commerce in some items, particularly wheat and iron, involves significant amounts of both Russia and Ukraine, the price of food and fuel has increased significantly. Prices rise as a result of decreased trade and manufacture of these commodities.

This occurred because producing the same volume of goods in a war zone was physically impossible. Sanctions imposed by the West on Russia have also significantly decreased supply to those nations.

Other industries are also impacted by these price increases. For instance, as businesses incur greater transportation expenses, rising fuel prices have an effect on the logistics sector. Food manufacturers who use grains as an ingredient must either absorb the increase in grain price or pass it forward to customers. These might be owners of restaurants or grocery stores, or they might be people.

Prices have also been impacted by lockdowns associated with COVID-19 in China, the largest exporter of products in the world. Lockdowns have raised prices by lowering output levels. The nations that depend largely on Chinese importers have been the most adversely affected, despite the fact that these lockdowns have had an influence on the entire world.

Nearly one-fourth of Sri Lanka’s total imports of commodities, which are on the edge of collapse, come from China, and it is not the only country to have such statistics. However, it should be mentioned that in Sri Lanka’s situation, excessive inflation is simply one factor contributing to the nation’s decline, with economic incompetence being the main offender.

Some G20 Countries with Surprisingly High Inflation

The G20 countries with the highest inflation rates right now are Argentina and Turkey. The rate in Turkey reached 85.51% in October 2022. (compared with prices in October 2021). Accordingly, items that cost 100 Turkish lira (Tl) in September 2021 would now cost Tl185.51. Inflation increased by more than 60 percentage points in just a year, the fastest rate of any G20 nation. Transport, food, and housing are the main factors contributing to price increases in this country.

In free fall against the US dollar is also the Turkish Lira. As of 16 November 2022, one lira was worth $0.054, which is one-quarter of the rate in 2017 and less than half the value it was at the same time in 2021. The decision to lower interest rates by President Recep Tayyip Erdoan has not lessened inflationary pressures.

Since invading Ukraine, Russia’s inflation rate has more than doubled. Its national statistics office reports that inflation has been declining since April 2022, when it reached a peak of 17.3%. Its inflation rate in October 2022 was 12.6%. Considering that consumer price growth rates are still low, the Russian central bank chose to lower interest rates in September. It anticipates that in 2024, Russia’s inflation rate will reach its desired level of 4%. The result of the crisis in Ukraine will have a significant impact on this.

What about USA and China?

The rate of inflation in the US is starting to level off. Even while it was still high (at 7.7% as of October 2022), this was the third month in a row that it had dropped. The decline follows a few iterations and months of the Federal Reserve raising interest rates from 3% to 3.75%-4% in an effort to reduce inflation to its 2% target. The rising cost of housing, food, and healthcare is what is causing inflation in the US.

China’s inflation rate is starting to drop down. In October 2022, its CPI increased to 2.1%. This marks a decrease of 0.7 percentage points from September 2022, when inflation was almost at the 3% cap. The cost of food, particularly pork and vegetables, was a major factor in price hikes. In an effort to boost its economy, China’s zero-Covid policy is about to come under scrutiny once more. It is unlikely to change, though, so a lower-than-anticipated GDP growth in the last quarter of 2022 seems inevitable.

What is Africa’s Story?

African countries account for three of the ten highest rates, with Zimbabwe having the highest inflation rate in the world at 269%. Only Argentina and Turkey from the G20 are among the top ten nations in the world, as was said above. Russia, which has the third-highest inflation rate among the G20 nations, is ranked 54th worldwide. Higher inflation rates are more likely to occur in nations that are politically fragile, politically dependent on imports, and relatively impoverished.

Let’s Take a Look at Ghana

In November 2022, Ghana’s annual inflation rate increased to 50.3% from 40.4% for the 18th consecutive month. Given the continuous depreciation of the cedi throughout the month, which increased the cost of imported goods (55.1% vs. 43.7% in October), it was the highest reading since May 2001 and significantly higher than the top of the central bank’s target band of 6%–10%. Housing and utility prices were the main factor driving price increases, up 79.1% from 69.6% in October, followed by furniture and domestic equipment (65.7% from 55.7%), transportation (63.1% from 46.3%), and food and non-alcoholic beverages (47.9% from 43.7%).

On December 13th, Ghana and the International Monetary Fund struck a preliminary staff-level agreement on a three-year finance package totalling over $3 billion. The loan is intended to assist Ghana in overcoming its economic challenges, which range from unmanageable debts to depleting reserves and a weak currency source: Ghana Statistical Service.

Food and non-alcoholic beverages account up 43% of the Consumer Price Index (CPI) in Ghana, along with 10% for housing and utilities, 10% for transportation, and 10% for apparel and footwear (8 percent). Additionally included in the index are education (7 percent), dining out and lodging (5 percent), booze, tobacco, and drugs (4 percent), and information and communication (4 percent). The remaining 9% of the overall weight is made up of leisure, sports, and culture; furniture, household equipment, and maintenance; personal care, social protection, and other products and services; health; and insurance and financial services.

What about the Ghana Cedi?

About three months ago, the Sri Lanka rupee was demoted from the onerous position of worst performer versus the US dollar to Ghana’s currency. Ghana’s economy is in a precarious position as a result of the unchecked decline of the Cedi versus the US dollar, which has resulted in at least 7 downgrades of the nation’s long-term bonds from three international rating agencies in less than 11 months this year.

However, earlier this month (December), Bloomberg reported that the Ghana cedi had outperformed all other currencies when compared to the US dollar.

The cedi performed the best when compared to the dollar among around 150 different currencies from around the world.

The currency gained 10% against the dollar despite having lost more than 50% of its value over the course of the year.

Can you write more about it? Your articles are always helpful to me. Thank you!

Thank you for writing this post. I like the subject too.

May I request more information on the subject? All of your articles are extremely useful to me. Thank you!